After a protracted period in the wilderness Arsenal are behaving like one of football’s financial superpowers again.

Since returning to the Champions League after a six-season absence, the Gunners’ revenue has boomed. In turn, that has allowed them to sign oven-ready superstars like Declan Rice and, this summer, Viktor Gyokeres for the type of fees which, for the vast majority of clubs, are the stuff of fantasy.

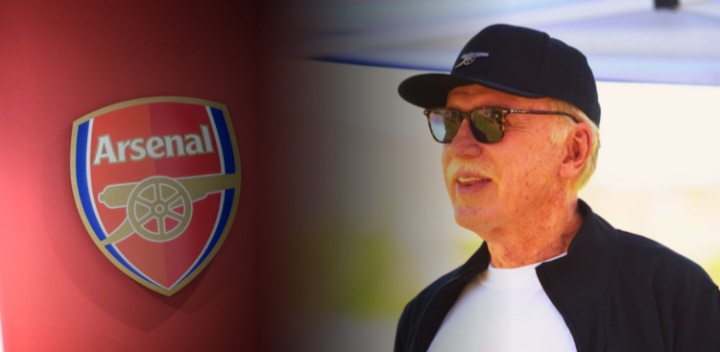

Under Stan Kroenke’s business model, the North London club is required to live within its means. That means that superstar signings or bumper new contracts for existing star players need to be fully funded by the club’s own revenues. Kroenke has already injected some £1bn-plus into Arsenal via his initial investment and later loans to the club, and he doesn’t plan on going much further into the red.

For that reason, the club’s business performance is integral to the funds made available to Mikel Arteta and Andrea Berta. And when the club is booming commercially, it should have maximum firepower in the transfer market too.

Securing long-term commercial partnerships is crucial, therefore. Arsenal’s deal with Adidas has been a roaring success so far, while their long-standing front-of-shirt and stadium naming rights partnership with Emirates will almost certainly be extended again when it expires in 2028.

The club has also dramatically increased its matchday income since it returned to Europe’s top table two seasons ago. In 2023-24, they were second only to Man United in terms of the cash they earned through the turnstiles. When the accounts for 2024-25 are released, they may claim top spot.

But – as the saying goes – the ocean is made of drops, and Arsenal have taken significant commercial strides in recent years by deepening their sponsorship portfolio. The training ground naming rights with Sobha Realty, for example, adds eight figures to their income every year.

And this summer, the Gunners have doubled their efforts in the commercial department.

In the last few weeks alone, Arsenal have signed sponsorship deals with Asahi Super Dry, Airwallex, Guinness, Stanley 1913 and – most recently – Bitpanda.

They have also renewed their deals with Konami and, seemingly, their controversial sleeve sponsorship agreement with Visit Rwanda.

The company has been named Arsenal’s official cryptocurrency partner in a multi-year deal, with the club promoting the deal with a campaign featuring Invincibles legend Robert Pires.

Speaking exclusively to TBR Football, University of Liverpool football finance expert Kieran Maguire assessed the club’s commercial performance.

“Arsenal have certainly faltered since 2016 in the post-Wenger era when they were consistently not qualifying for the Champions League,” he said.

“Being based in London can be both a positive and a negative from a commercial perspective. The positive is that it is a prime location and you can charge premium prices. The negative is that there is a lot of competition for sponsors.

“Chelsea’s greater success in the last decade means they have become slightly more desirable. Arsenal are now in a position to claw that back.

“They do have a bigger stadium, although a lot of observers are saying it looks dated. Getting the mix and the yield on ticket prices at the Emirates is something they need to look at.

“It would be a very expensive expansion, but we have seen Stan Kroenke get involved with very expensive stadium projects in the United States, so it can be done.

“But I think the little-and-often strategy when it comes to commercial partnership is being adopted by all the big clubs.

“If you get a dozen deals at £1-2m, that covers the wages of two world-class players. That is the way they see it.”

Success on the pitch begets success in the commercial stakes, and while Arsenal haven’t yet won a coveted Premier League or Champions League under Arteta, their reinstatement as a regular contender for the biggest silverware has had an undeniable impact financially.

The latest research from Brand Finance, a global consultancy firm, has valued Arsenal’s brand at over £1bn for the very first time.

That was a remarkable 21 per cent increase on the same time last year. Significantly, Arsenal also scored exceptionally in the ‘brand strength’ assessment, which rates how resilient football clubs’ brands truly are.

The Gunners received a score of 92.8 in this category, giving them an AAA+ rating, behind only Manchester United, Barcelona, and Real Madrid in global terms.